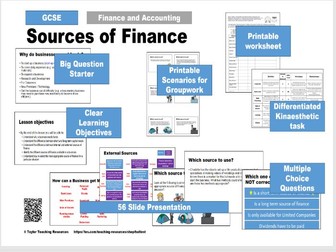

Sources of Finance - GCSE (9-1) Business

Comprehensive lesson containing a full presentation and worksheet.

(includes model answers)

The lesson outlines all the specification points of Sources of Business Finance within the GCSE (9-1) Edexcel Business Studies course (useful for other exam boards too)

This lesson teaches the following content:

Sources of finance for a start-up or established small business:

● short-term sources: overdraft and trade credit

● long-term sources: personal savings, venture capital, share capital, loans, retained profit and crowd funding.

Click on the links below to check out some of our FREE GCSE (9-1) Business lessons and Worksheets to get a flavour of what this resource entails:

Dynamic Nature of Business Lesson

Market Research Lesson

Dynamic Nature of Business Worksheet

We really appreciate feedback on our resources so if you kindly leave a review down below, you will be able to claim any resource (up to the value of this resource) from our shop for FREE. Just email Resourcify321@gmail.com with your username and your chosen resource. Your chosen resource will be sent to you within 24 hours.