Outstanding teaching resource for teaching year 6 children about salary, tax and wages.

Includes teaching slides for four high quality lessons.

Lesson 1: Defining salary, tax and wages

Gives visual representations for net and gross salary

Lesson 2: Calculating wages based on hourly rates

Lesson 3: Calculating tax deductions from salary

Lesson 4: Calculating net pay

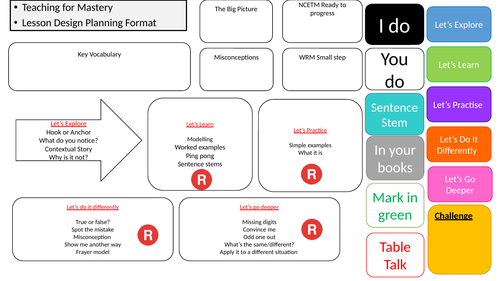

Throughout each lesson their is ping pong slides for “I do, you do”

The lessons include sentence stems and steps to calculating net pay and tax deductions.

Small steps with differentiated questions.

The purple questions are the easier questions and each slide progresses in difficulty.

Visual representations for the difference between net and gross salary.

This unit allows children to practice their calculator skills ready for year 7.

This is also an appropriate resource for Key stage 3 and year 5 depending on the ability of the children.

Get this resource as part of a bundle and save up to 77%

A bundle is a package of resources grouped together to teach a particular topic, or a series of lessons, in one place.

Massive year 6 maths bundle

Core and additional engaging maths topics based on tax, salaries and holidays!

Real life maths bundle

Great for year 5 and year 6 in summer term after assessments. Can be used in KS3 3 weeks of planning Topics: Net salary Gross salary Tax Pension Calculating net pay Planning a holiday

Mortgages and tax bundle

2 weeks worth of outstanding maths resources Teaching slides and worksheets on the powerpoints

Something went wrong, please try again later.

This resource hasn't been reviewed yet

To ensure quality for our reviews, only customers who have purchased this resource can review it

Report this resourceto let us know if it violates our terms and conditions.

Our customer service team will review your report and will be in touch.