84Uploads

10k+Views

6k+Downloads

Economics

Indirect Taxation - Economics

This presentation contains 73 slides and introduces what tax is before going into detail about indirect taxation and how to interpret diagrams that ask questions on indirect taxation.

Included in this presentation:

A Catchphrase starter activity

A true of false short quiz that asks students about 4 different types of tax around the world

Information about how much tax is generated in UK compare to poorer countries, what that tax revenue is spent on and how it is sourced

Distinctions between direct and indirect taxes. Although Econs exams focus more on indirect taxes, explaining direct taxes gets students engaged into the lesson

A ‘how much tax does BOJO pay’ activity that students really enjoy

Notes on indirect taxation

A step by step explanation of how to interpret and make calculations on tax diagrams

A calculation activity that students need to complete

Notes on disadvantages of tax increases

Evaluative suggestion points the extent to which tax rises are harmful

These slides took me an hour and a half to go through with my students.

Balance of Payments

Full lesson on balance of payments:

Purpose of balance of payments

Explanation of different sections

Causes of surpluses and deficits

Consequences of global trade imbalances

Links to deficits and surpluses to other macroeconomic objectives

133 slides in total

Colourful, contextualised, lots of activities with examples, animations

This resources lasted a week of lessons

Cross Elasticity of Demand

This PowerPoint includes:

An activity that introduces students to the concept of complements, substitutes and unrelated goods

A activity where students have to match pairs of complement and substitutes goods

An activity where students have to calculate the XED of a pair of goods

Detailed notes on how to calculate XED and what the data means

This presentation contains 21 slides and took me 45minutes to complete

Cross Elasticity of Demand

This PowerPoint includes:

An activity that introduces students to the concept of complements, substitutes and unrelated goods

A activity where students have to match pairs of complement and substitutes goods

An activity where students have to calculate the XED of a pair of goods

Detailed notes on how to calculate XED and what the data means

This presentation contains 21 slides and took me 45minutes to complete

Indirect Taxation WORKSHEET

A worksheet that tests understanding of directly and indirect taxation.

There are 4 activities in this worksheet:

A fill the blanks activity that tests students understanding of types of direct and indirect taxation and the correct terminology used depending on the tax being discussed

An activity where students need to calculate tax per unit, incidence on producers, consumers and government revenue

An activity where students need to explain why the incidence on the producer / consumer changes depending on the price elasticity of demand

An extension of activity 2 where students are given 4 additional diagrams where they need to complete additional calculations and label the incidence / tax revenue

3 multiple-choice questions on indirect taxation

Detailed answers of all* activities are provided in this worksheet

This activity took between 20 and 30 minutes for my students to complete

Market Failure (Types of)

This lesson introduces the concept of market failure and explains what each of the key types of market failure are (externalities, under-provision of public goods and information assymmetry)

Included in this presentation is:

A colourful title slide with the key learning objectives

A ‘guess the question’ starter activity with answers

A step-by-step explanation as to what market failure is

Video showing an extreme example of externalities

Fill the blanks externality activity

Externalities sorting activity with answers

Positive externality activity

Information gap activity

Detailed and colourful notes throughout

This presentation is 32 slides in length and took me one hour to go through

Market Structures and Competition

This lesson can be used either to teach Business students about competition, market structures and how consumers can be affected by anti-competitive practices OR to teach Economics students about the different features of market structures and why competition / a lack of competition affects different stakeholders.

Included in this lesson:

A colourful and detailed title slide outlining the key learning objectives

An income elasticity of demand starter activity suitable for both Business and Economics students (calculation / explain / diagram question). A printable slide of the questions has been provided with a detailed answer key on next slide for peer marking.

A detailed and contextualised example of how a lack of competition affects different stakeholders (Epic Games legal battle with Apple over Fortnite)

Brainstorming activity on competition

A rank in order activity on types of competitive markets

Detailed notes on competition, monopolies, oligopolies, monopolistic competition, perfect competition, Game Theory, types of anti-competitive practices such as Cartels, OFT.

This presentation contains 37 slides and took me an hour to go through with my students.

Rational Decision Making (Economics)

17 slides in total, including a fun starter activity

This presentation took me 30 minutes to go through with my class

Demand (SMART NOTEBOOK VERSION)

Please note that this is a SMART NOTEBOOK presentation and not a PowerPoint presentation

Revenue (Economics) - TR, MR, AR, PED

This 100 slide lesson details:

the meaning of total revenue, marginal revenue and average revenue

the relationship between marginal revenue and price elasticity of demand

the concept of price-taker and price-maker

the formula used to calculate each type of revenue

diagrams for TR, MR and AR depending on whether the firm is a price-taker or price-maker

Engaging activities are provided throughout (answers included)

Questions and answers are also provided

Resource is colourful and interactive with animations throughout

This lesson took me 4 hours to complete with my students

Costs (Economics) - TFC, AFC, TVC, AVC, AC, TC, MC

A 125 slide complete lesson on short-run economic costs. The presentation inlcudes:

Colourful and interactive title slide with timer, animations and learning objectives

Editable key term recap starter activity

Detailed, step by step explanations of each cost (diagram and calculation)

Printable slides with activities for students (answers included)

Past exam questions (with answers)

This lesson took me three hours to complete with my students.

Positive Normative Worksheet and Teams Form Quiz

Save yourself some time with this multiple-choice question activity on positive and normative statements, and the economic problem.

You can either use:

The paper worksheet of 44 questions with answers included. Students can peer mark this to save you time

AND / OR

The same activity but with an additional 5 questions as Teams Quiz you can set for classwork or homework. The activity self marks once students finish the quiz so that you can download the results after to see how they have done. The link for you to duplicate and download this has been included at the end of the worksheet.

This resource has been designed to save you time…

Teaching shouldn’t just be about work - get yourself down to the pub / spend some time with your family / go for a walk!

Please let me know if you have any issues / questions

Demand and the Demand Curve

A PowerPoint presentation on demand includes:

Catchphrase starter activity

Demand activity (graph paper required)

Detailed explanations of demand, reasons for shape of demand curve, movements, shifts, ceteris paribus

This lesson took me 60 minutes to go through

Types of Taxation (Direct and Indirect)

A colourful and detailed presentation that explores types of taxation. Included in this presentation:

A fun Catchphrase starter activity where students have to look at images to guess the name of a product or service (my students love this!)

An initial true or false quiz about types of taxes (England specific)

4 slides illustrating how much tax revenue the UK generates in comparison to other countries and how that tax revenue is spent. A sample payslip is also shown to illustrate some of the deducations are taken from income tax

Colourful and detailed examples of the main forms of tax students need to know about (income, corporation, VAT, National insurance, business rates)

A ‘how much income tax does Boris pay!’ activity that students love. It illustrates that income tax brackets are different at different thresholds of income

Disadvantages of taxation

Useful tips and notes as to how to evaluate a question that refers to taxation

This lesson took me an hour to complete

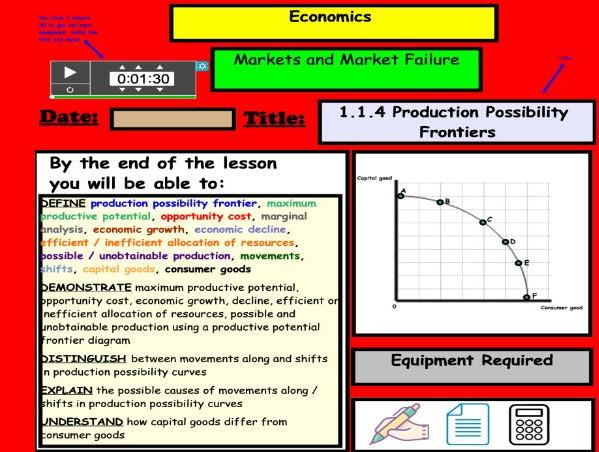

Production Possibility Frontier

A colourful, informative and engaging PowerPoint lesson on the production possibility frontier / curve (PPF/PPC).

Included in this lesson are:

A colourful and detailed title slide providing detailed learning objectives

A discussion starter activity that introduces the concept of choice

A mix and match activity where students need to identify and explain the difference between economic and free goods

Detailed notes

Consumer goods activity

Step by step break down of what the PPF is, opportunity cost, how it is calculated, marginal analysis, movements, shifts

There is also a free blank template of a PPF on my store that you can print and get students to fill in as it is explained

Business Objectives (Economics)

This comprehensive resource contains 153 slides on activities, notes, exam questions , mark schemes, videos and animations to cover Business Objectives.

This resource explains what is meant by profit maximisation, revenue maximisation, sales maximisation and satisficing. This topic is well known for being challenging so this resource has been designed to explain these concepts step by step. Each objective has been contextualised with a range of activities (calculations, quess the box, ppqs, videos, etc) to help students understand.

The diagrams for these objectives are explained in my other resource (revenues, costs and profit).

This is a very detailed lesson and look me 5 hours to go through.

Public Expenditure (Macroeconomics)

This 83 slide presentation covers public expenditure (4.5.3 in Edexcel specification).

Included in this resource:

A colourful and engaging title slide with learning objectives, auto date and time, animations and timer (with short bell)

Editable recap starter activity (knowledge recall)

Lots of interesting and engaging activities surrounding taxation, such as calculating Boris Johnson’s salary as PM, taxes on lottery winnings and game shows

Ranking activity on UK public expenditure

Detailed notes on capital and current expenditure, transfer payments, reasons why this may change and impact on wider economy

Contextualised examples and embedded videos, such as HS2

15 marker practice essay on financial markets (prior topic) with scaffolds and model answer

This lesson took me two hours to complete

Consumption (Aggregate Demand)

This resource explores the consumption component of aggregate demand.

Included in this resource:

Colourful and engaging title slide with learning objectives, autodate, bell, timer and animations

A fun catchphrase starter activity (guess the business or product just from the pictures)

Fill the blanks starter activity that recaps what aggregate demand is

Detailed notes on what consumption is and the factors that affect it

Video contextualising factors affecting consumption

Examples of AD components in other countries

5 marker practice activity, with structure and model answers

Answers included for every activity.

This resource took me 1 hour to go through with my students

Quantitative Skills (Economics) Worksheet

This is a simple activity for students to practice some of the quantitative skills and topics covered in A Level Economics, such as elasticity, terms of trade and the multiplier, business objectives.

There are 50 questions with answers included

Economic Growth Multiple-Choice Questions

This is a simple activity comprising of 20 multiple choice questions on the content covered through the topic on economic growth, such as types of GDP, purchasing power parities, index numbers, subjective happiness, limitations of using GDP to measure economic growth.

All answers are included