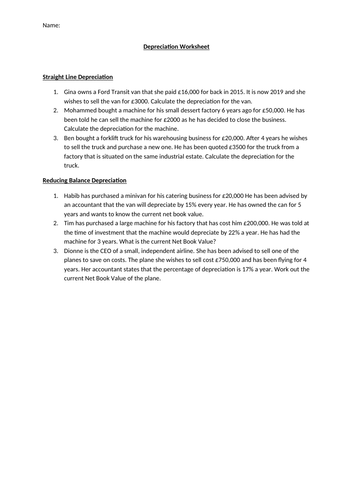

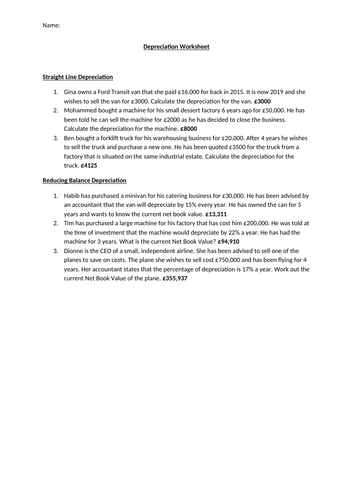

This full lesson, with supporting handout covers how to calculate Straight Line and Reducing Balance Depreciation. This is found within F1 of Learning Aim F for Unit 3: Personal and Business Finance. However, this lesson on depreciation can be adapted to use with alternative courses.

Images removed for copywrite reasons, you will need to add your own images e.g. business logos.

Get this resource as part of a bundle and save up to 53%

A bundle is a package of resources grouped together to teach a particular topic, or a series of lessons, in one place.

BTEC Level 3 Business Unit 3: Personal and Business Finance Full Unit

This full unit covers all learning aims for Unit 3: Personal and Business Finance. In this pack you will find PowerPoints (with tasks including practice exam questions), templates and handouts. Everything you need is in this bundle, taking the stress out of teaching and planning this unit of work. This unit contains: - Learning Aim A - Learning Aim B - Learning Aim C - Learning Aim D - Learning Aim E - Learning Aim F There are 20 resources bundled together for an amazing price (£76 if bought individually).

BTEC Level 3 Business Unit 3: Personal and Business Finance Learning Aim F Complete

This bundle fully covers Learning Aim F for Unit 3: Personal and Business Finance. These lessons cover: F1 - Statements of Comprehensive Income F2 - Statement of Financial Position F3 - Measuring Profitability F4 - Measuring Liquidity F5 - Measuring Efficiency F6 - Limitations of Ratios

Something went wrong, please try again later.

Some Depreciation answers are wrong on the answer worksheet.

A good resource that goes through both straight line depreciation and the reducing balance method. Worksheet is ideal to set students for a remote learning task.

Report this resourceto let us know if it violates our terms and conditions.

Our customer service team will review your report and will be in touch.